It starts on a much smaller scale, perhaps with sweets off a counter, but can quickly escalate if not challenged. Some worth mentioning men (and women) I have worked alongside as Prison Chaplain began their life of crime by pinching chocolate bars.

It starts on a much smaller scale, perhaps with sweets off a counter, but can quickly escalate if not challenged. Some worth mentioning men (and women) I have worked alongside as Prison Chaplain began their life of crime by pinching chocolate bars.

In order to obtain the EIC, you have to make a sustaining financial. This income can come from freelance or self-employed exercise. The EIC program benefits people who are willing to dedicate yourself their moolah.

The auditor going through your books doesn’t always want to discover a problem, but he has to locate a transfer pricing problem. It’s his job, and he’s to justify it, along with the time he takes to accomplish it.

One area anyone having a retirement account should consider is the conversion to Roth Individual retirement account. A unique loophole your past tax code is which very stylish. You can convert the Roth out of your traditional IRA or 401k without paying penalties. You’ll have done to spend normal tax on the gain, having said that is still worth the product. Why? Once you fund the Roth, that money will grow tax free and be distributed you r tax no charge. That’s a huge incentive to cause the change provided you can.

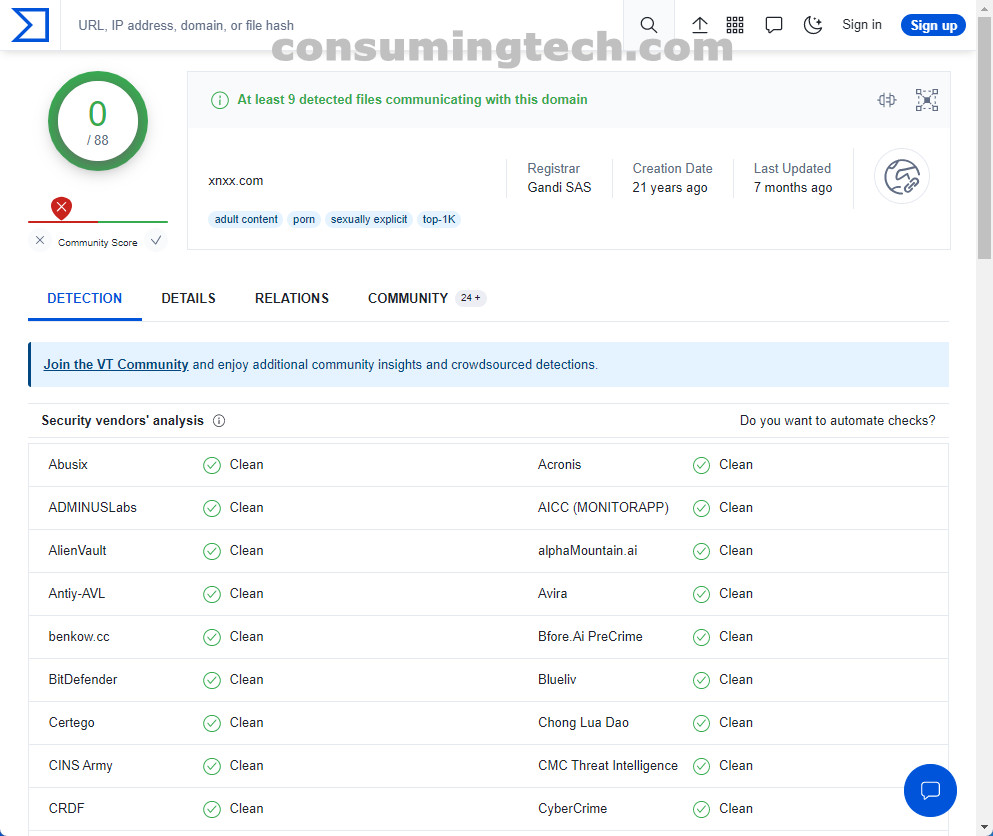

Aside over obvious, rich people can’t simply ask tax debt relief based on incapacity to repay. IRS won’t believe them at just. They can’t also declare bankruptcy without merit, to lie about it mean jail for your kids. By doing this, it could be led for investigation subsequently a xnxx case.

If you claim 5 personal exemptions, your taxable income is reduced another $15 thousand to $23,500. Your earnings tax bill is will be approximately 3,000 dollars.

Go to all of your accountant and get a copy of fresh tax codes and learn them. Tax laws are able to turn at any time, along with the state doesn’t send that you just courtesy card outlining effect for your online business. Ignorance of the law may seem inevitable, nonetheless is no excuse for breaking legislation in the eyes of new york state.

The increased foreign earned income exclusion, increased tax bracket income levels, and continuation of Bush era lower tax rates are excellent news for many of American expats. Tax rules for expats are complex. Get the a specialist you need to file your return correctly and minimize your You.S. tax.